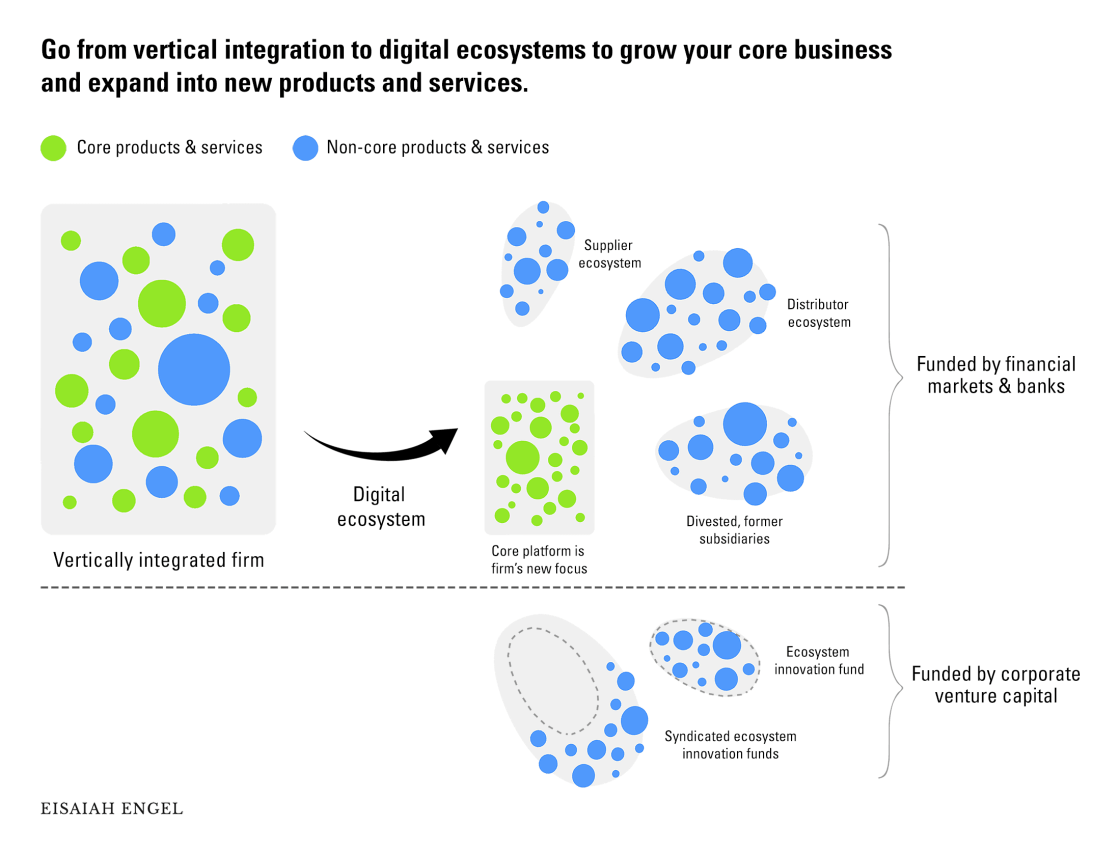

In December 2020, I published Innovation Casino, a book about how medium-sized and large enterprises can use corporate venture capital (CVC) to grow their digital ecosystems. Here, you can read a chapter-by-chapter summary.

What’s in it for me? Beat the odds with CVC for digital ecosystems.

The book, Innovation Casino, uses its self-titled metaphor to describe the odds of generating financial returns from innovation so you can beat them. For decades, vertically integrated firms have made high-stakes bets on innovation. However, in the innovation casino, it is the players who bet big. Players think they will beat the odds, but few do. By taking a fresh look at your odds, you can retool your approach to win more frequently just as the house does in a casino.

Continue reading